Jan. 16, 2023 – Napa Valley, California —The downturn in U.S. wine sales is real and substantial, confirmed by multiple data sources and extends all the way to actual consumption. Pandemic effects, inflation, competition, high inventories and channel switching all have had impacts, but don’t explain the downturn completely.

So what is the #1 reason that U.S. consumers are drinking less wine? The answer has been confirmed in a new Wine Market Council (WMC) study of 1500 U.S. consumers, which utilizes a specific statistical method called Random Forest Analysis. This is a special technique that combines and compares many different points of data into ‘decision trees’ to create a ‘forest,’ which ultimately ranks the most important underlying causes to a research question. The survey and analysis were completed by WMC partner, NielsenIQ, building on top of a previous analysis of household purchasing data.

So what is the #1 reason that U.S. consumers are drinking less wine? The answer has been confirmed in a new Wine Market Council (WMC) study of 1500 U.S. consumers, which utilizes a specific statistical method called Random Forest Analysis. This is a special technique that combines and compares many different points of data into ‘decision trees’ to create a ‘forest,’ which ultimately ranks the most important underlying causes to a research question. The survey and analysis were completed by WMC partner, NielsenIQ, building on top of a previous analysis of household purchasing data.

Primary Driver is General Reduction in Alcohol Consumption

The analysis shows that the primary driver of the downturn in wine sales is a reduction in alcohol consumption generally. What looked like different results for different categories of drink over the course of 2023 was mostly a result of timing, distribution channel effects and competition within the beverage alcohol category. At the consumer and household level, both the consumer survey and NIQ household purchasing data showed most beverage alcohol categories declined over the course of 2023, at roughly similar rates.

This larger trend of reducing alcohol has been abetted by a large minority of consumers cutting back spending in general, with alcohol considered an easy or healthy place to economize. Here wine is vulnerable in terms of cost per serving or container (750ml). For wine specifically, there have also been switching losses to spirits (in particular RTDs) and craft or imported beer. Wine is also being chosen less often for certain occasions. However, this is a secondary factor in the downturn, and partially offset by new consumers and share gained from hard seltzers and less expensive domestic beer.

While wine has lost customers to some other categories, and gained from a few, the overwhelming impression from the household purchasing data is volatility. Many consumers are jumping back and forth between drink categories on any given occasion. In household purchasing data, multiple products that gained customers in 2021 or 2022, lost them in 2023 and the reverse.

While wine has lost customers to some other categories, and gained from a few, the overwhelming impression from the household purchasing data is volatility. Many consumers are jumping back and forth between drink categories on any given occasion. In household purchasing data, multiple products that gained customers in 2021 or 2022, lost them in 2023 and the reverse.

Much of the cause of the downturn is due to the increasing number of negative health reports on alcohol, as well as a strong wellness trend. In the past, wine was actually listed as optional on the Healthy Eating Pyramid (see photo from Harvard School of Public Health), but now, some parties, including the World Health Organization, have warned against even moderate levels of alcohol consumption.

Actions the Wine Industry Can Take to Remain Relevant

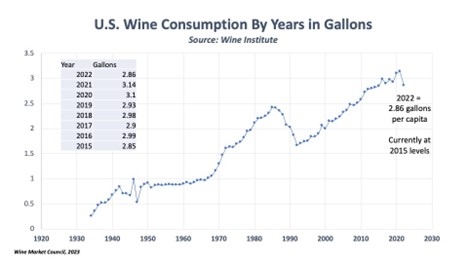

This isn’t the first time in history that wine sales and consumption have decreased. In looking at the chart below, it is obvious that this also occurred in the late 1980s and early 1990’s. In both instances, certain actions were taken to change the course to a more positive curve, encouraging moderate consumption. It is time for the wine industry to take action again, and following are a few ideas on how to accomplish this:

- Create Innovative Wine Products – wine coolers and white zinfandel were two of the new wine products introduced in the U.S. during past slumps. Now is the time to get creative again – there is still room in the market for more wine-based RTDs, zero or low calorie wines with no sugar added, innovative packaging and sizes, wine cocktails, and many other options.

- Embrace the No-Low Alcohol Movement – the old saying, ‘if you can’t beat them, join them’ suggests that more wineries should consider developing at least one ‘no-low’ alcohol wine for consumers. Drizly reported non-alcoholic wine, beer, and spirits were up 54% in the first half of 2023. Not only do no-low wines satisfy health-oriented consumers, but they create more inclusive drinking opportunities for those who have elected to maintain a sober lifestyle.

- Communicate Positive Benefits of Wine – wine has been around for more than 8000 years and is at the heart of many cultural traditions. In the U.S. we can’t legally promote the health benefits of wine, but there are many other benefits we can: agricultural product, linked to art, music and romance, sustainable/organic, small family businesses, economic driver, etc. To assist, Wine America.org has put together a number of communication points at their new web portal, the Magic of Wine.

- Collaboration – this is not the time to sit around and say ‘let the large companies tackle this.’ This is a time for collaboration, teamwork and pulling together as a unified industry. Indeed, much of the increase in wine sales and premiumization in the 2000’s were led by smaller and family wineries.

Some Positive News About U.S. Wine Consumers

The new Wine Market Council study shows that while wine has lost significant share among marginals, and seen some reduction in frequency among core wine consumers, the remaining consumers appear to be loyal, engaged and continue trading up from the lower price ranges, although they have cut back in the highest ranges.

High-end wine consumers are, in particular, spending more and increasing purchases in the $20-$50 range. Those in their 20s, and Gen-Z in particular, have lower rates of drinking wine, but comparison to similar data in 2006-2008 shows them adopting wine only slightly less than Millennials at around the same age. Consumers in their thirties are among the most frequent drinkers of wine. On the other hand, the increase in recent years of those abstaining from alcohol among older (60+) consumers is significant.

This new report, along with Wine Market Council’s recent High-End Consumer Report, both highlight some of wine’s strengths as seen by U.S. consumers:

- purer, more natural, less processed product

- sophisticated and worldly

- evokes memories of travel, events, friends/family

- relaxing and de-stressing

- social, warm, intimate, connecting, romantic

- interesting and varied flavors

- association with and enhancing meals and food.*

About Wine Market Council and Membership

Interested in obtaining more detailed data on U.S. wine consumers? Consider becoming a Wine Market Council (WMC) member. WMC is a non-profit organization powered by members with an interest in advancing the U.S. wine market and industry. Established in 1996, the mission of WMC is ‘to be the leader in forward-looking market research on U.S. wine consumer buying habits, attitudes and trends.’

Members of Wine Market Council have access to cutting-edge research on the U.S. wine consumer, along with member webinars, newsletters, access to data files and statistics, and other benefits. Membership starts as low as $400 per year for access to webinars and reports, and as low as $1000 per year including data files – depending on the size of your organization. Members include wineries, distributors, growers, importers, regional, national, and international trade associations, and affiliates. For more information on membership and costs, please see https://winemarketcouncil.com/join/.