Getting a consistent take on wine sales in the U.S. remains a crap shoot

even in the data-driven, all-things-can-be-measured 21st century.

By Jeff Siegel

Wine sales in 2021 declined 0.5% in volume, which was the first volume decrease in 27 years. On the other hand, volume fell 10% in 2021, though value was only down 6%. Then again, dollar volume increased 16.8% in 2021.

Confused? You aren’t alone.

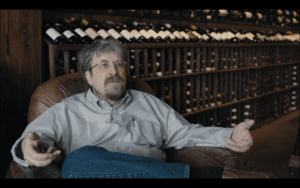

“Anyone who says they know what’s happening to total sales is fooling themselves,” says Silicon Valley Bank’s Rob McMillan, one of the leading wine industry analysts in the country. “Today, average isn’t a good way of viewing the market. We have winners and losers.”

In fact, getting a consistent take on wine sales in the U.S. remains a crap shoot – even in the data-driven, all-things-can-be-measured 21st century. Wine sales data is still a mix of proprietary data, estimates and modeling, and retail sales numbers that are often missing key retail sales statistics.

So when three respected surveys, such as Impact Databank, Nielsen and Gomberg Frederickson claim different results for more or less the same period of time, no one is surprised.

Read the Fine Print

Frankly, says Christian Miller, who runs Full Glass Research in the Northern California Bay Area, that’s perfectly normal. For one thing, wine is made by thousands and thousands of producers and sold in thousands and thousands (and thousands) of outlets. By comparison, a handful of companies make cars and they’re sold through dealerships associated with the manufacturers — so new car sales are easy to track.

“The numbers really depend on what you’re looking for,” says Miller, “because there’s no one survey that really covers everything. The best advice? Look at the footnotes to any study to see what the numbers are actually describing.”

Know Your Sources

The most important data, say several leading industry analysts, comes from the following sources (and in no particular order). Most are proprietary, and the results that are released tend to be overviews of each survey’s more detailed data, which is sold to subscribers:

- Nielsen and IRI. This is sales scan data, which includes most of the biggest national and regional retailers in the country (save Trader Joe’s and Costco). But it doesn’t include most independents or mom and pop shops, DTC and on-premise sales. Hence, says Miller, it’s very good at parsing sales of, for example, Australian wine costing less than $20, but not as accurate about something like Cotes du Rhone, which is more of an on-premise and independent retail wine.

- SipSource. These numbers, put together by the biggest wholesalers in the country, may one day give the most complete picture. Since the data come from wholesaler depletions, it includes everything but DTC and some important, smaller wholesaler/importers. That’s because all wine has to go through a wholesaler. Currently, though, the results are more broad and don’t go into many specifics about varieties and regions.

- Impact Databank. This study, which includes modeling and estimates, comes from the company that owns the Wine Spectator and is often used to track sales of the biggest brands in the country.

- Gomberg Frederikson and BW 166. Several analysts said these are likely the most comprehensive. They take into account a variety of sales data and tax information, as well as numbers not always found in other reports, and use modeling.

- Silicon Valley Bank. This highly respected study is the basis for the annual SVB state of the wine industry report, which gathers information from a variety of sources.

- Ship Compliant. Probably the best look at DTC sales.

- Federal and state agencies. Ironically, the various governments that regulate alcohol have some of the best information, including tax collections, permits and the like. The catch is, it’s scattered all over the place — and not just because there are 50 states. The federal government, for instance, has information in at least two agencies, TTB and the Commerce Department, but doesn’t collate its own data. _______________________________________________________________

Jeff Siegel

Jeff SiegelJeff Siegel is an award-winning wine writer, as well as the co-founder and former president of Drink Local Wine, the first locavore wine movement. He has taught wine, beer, spirits, and beverage management at El Centro College and the Cordon Bleu in Dallas. He has written seven books, including “The Wine Curmudgeon’s Guide to Cheap Wine.”